In response to the COVID-19 pandemic, the United States (US) healthcare industry embraced remote patient monitoring devices to deliver clinically effective and safe care in the comfort of patients’ homes. Remote patient monitoring (RPM) offered the double benefit of reducing the burden on an overwhelmed health system and workforce, while also reducing patient’s exposure to and spread of COVID-19.

RPM devices are non-invasive technologies that measure common physiological parameters such as heart rate, blood pressure, sleep patterns, and temperature (FDA 2021). These devices collect and monitor a patient’s health while working in tandem with data analytics software to evaluate and notify healthcare providers of patient status, including concerns.

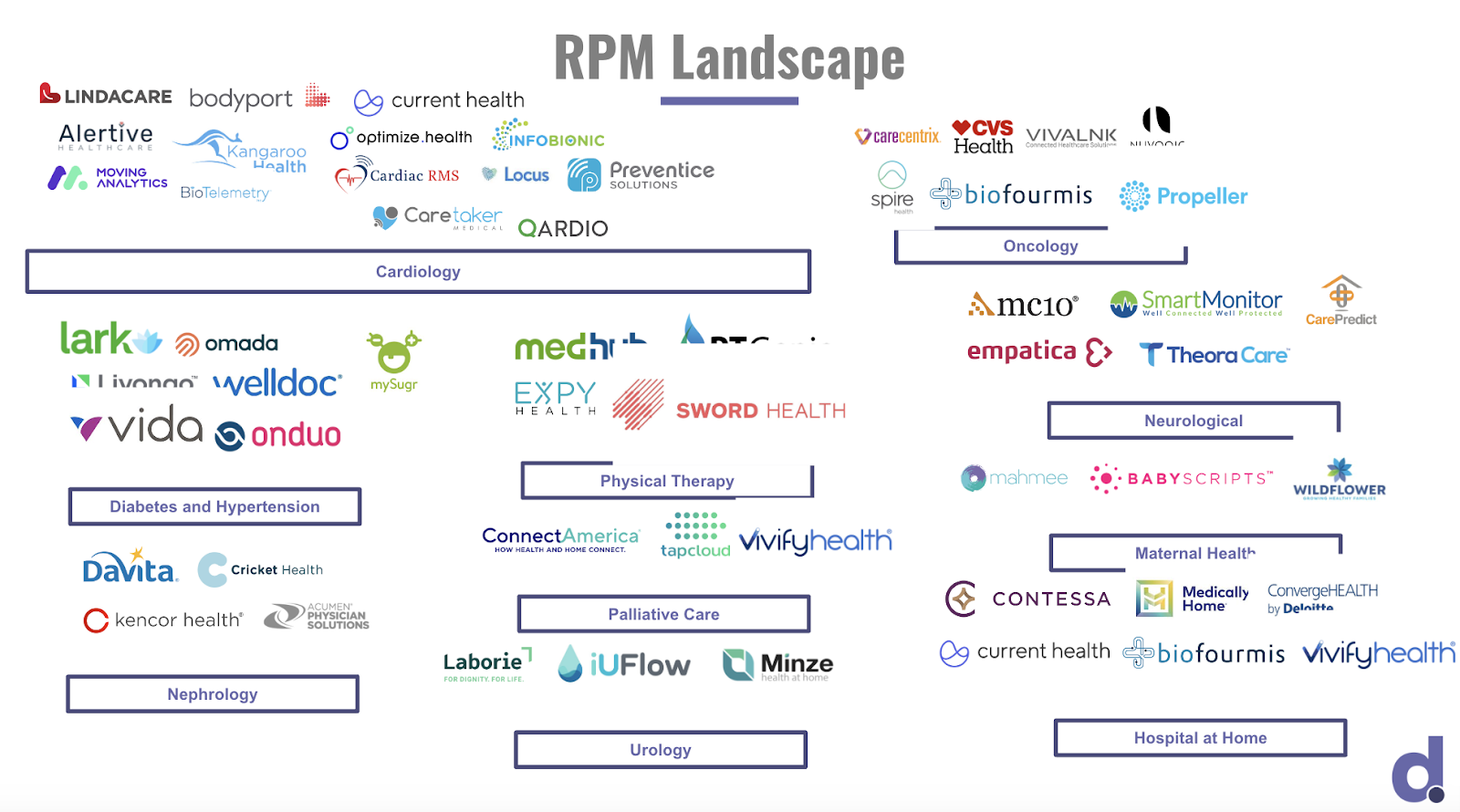

At Decimal.health, we’ve observed a continuous market momentum for RPM solutions in different medical areas including cardiology, oncology, diabetes, neurology, and hospital-at-home.

The Current Landscape of RPM Companies by Clinical Area

How do you Categorize RPM Companies?

When parsing the RPM landscape, we recommend categorizing companies based on their service offering. RPM companies can be broken down into three service offerings:

- Patient-facing device or hardware companies allow patients to track or collect health information such as vital signs, activity and medication adherence themselves. Example companies are LucidAct, Vivalink, and Omron.

- Data platform companies provide the patient- or provider-facing software platform to manage and analyze incoming health data from the devices and help deliver clinically relevant information to the supervising healthcare team. Example companies are Optimize.health, Vivify Health, and Locus.

- Clinical monitoring companies provide outsourced RPM care and monitoring services for healthcare organizations. These companies often also support healthcare organizations with billing the Medicare, Medicaid, or health insurance companies for RPM services. An example company is Lacuna.

What’s the Investment in RPM Companies?

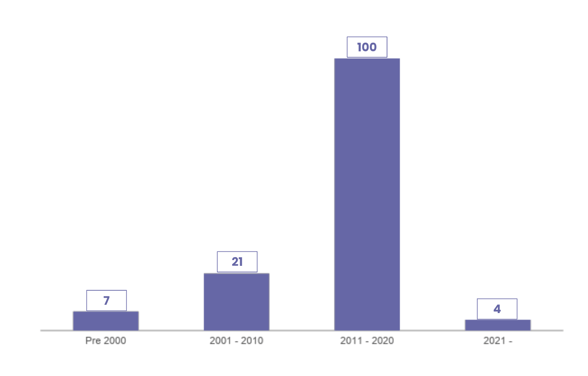

Before 2010, there was a smattering of RPM start-ups who started testing and laying the groundwork for integrating the technology into health settings (Crunchbase 2022). However, things started to change dramatically after 2010. Between 2011 to 2020, the number of RPM start-ups surged with the biggest uptick in companies focused on cardiology, diabetes, and pulmonary (Crunchbase 2022).

The Growth of New RPM Companies Headquartered in the US

There was significant growth in new RPM companies between 2011-2020 (analysis performed using Crunchbase 2022 data).

After 2020, coinciding with the COVID-19 pandemic, we saw a reduction in the number of new RPM companies. However, while the number of new RPM start-ups has decreased, there was still strong investment in the sector.

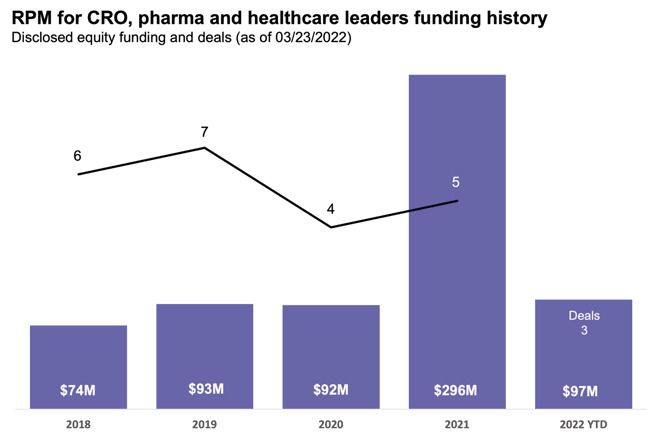

Since 2018, RPM companies have raised at least $652M with a record $269M raised in 2021 (CBInsights 2022). RPM companies leading on investment are Huma ($287M raised), AliveCor ($65M raised), and BioIntelliSense ($45M raised) (CBInsights 2022).

Disclosed equity funding/investment and number of deals in RPM for clinical research organizations (CROs), pharmaceutical and healthcare organizations between 2018 to 2022. Analysis and graph produced by CBInsights ( CBInsights 2022) .

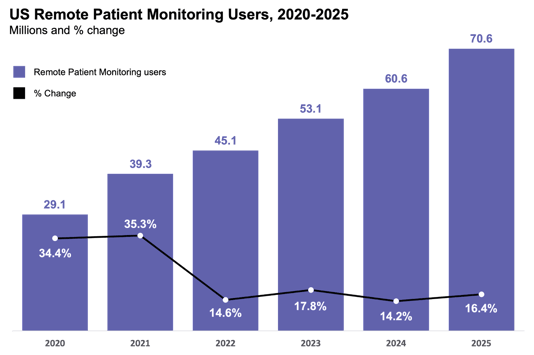

Coinciding with the continued investment in existing RPM companies, we saw steady growth in the numbers of US-based patients using RPM devices. Current analysis shows that the adoption of RPM is trending upwards towards a point of saturation (see the corresponding decrease in percentage change in RPM users in the figure below) (Insider Intelligence 2023). Insider Intelligence predicts that by 2025, there will be 70.6M patients, or 26.2% of the US population using RPM devices (Insider Intelligence 2023).

The number of US patients using RPM devices from 2020 and forecasting to 2025. Analysis and graph produced by Insider Intelligence (Insider Intelligence 2023).

Tailwinds of RPM

| The COVID-19 Pandemic | The pandemic initiated a drastic shift to digital health strategies and technologies worldwide. Healthcare organizations started moving patient care and management away from traditional care settings (e.g., hospitals, clinics, nursing homes) to home-based or community-based settings. In the US, many healthcare organizations adopted or increased the use of RPM devices to reduce patients’ exposure to COVID-19, alleviate the burden on their resources, and free up hospital beds and resources for treating COVID-19 patients. |

| Favorable Government Policies | The Centers for Medicare and Medicaid Services (CMS) acknowledge the value of RPM programs for increasing access to care and reducing the burden on hospitals. CMS uses RPM-specific Current Procedural Technology (CPT) codes to reimburse providers for setting up RPM devices, analyzing patient’s health data, and interacting with the patient in response to the information received from the device. CMS expanded reimbursement options during the pandemic and intends to keep these changes. During COVID-19, the Food and Drug Administration (FDA) introduced Emergency Use Authorizations (EUAs) for medical devices related to RPM and used by healthcare providers to reduce the exposure and spread of COVID-19 (FDA 2020). The FDA also recognizes that digital technology rapidly changes and can become outdated quickly. In response, the FDA has made a conscious effort to create supportive approaches to approval of and post-market surveillance of digital technology. |

| Growing investment | There continues to be significant investment and M&A activity in RPM. Best Buy Health, for example, acquired RPM technology vendor Current Health in 2021 to accelerate their digital health strategy. The acquisition was one of the largest, if not the largest, digital health acquisitions in 2021 – totally nearly USD$400M (Fierce Healthcare 2021). |

| Evolving Consumer Health Technology | Wearable devices are leading the way in promoting wellness and healthy behavior (e.g., sleep, physical activity). Rock Health’s 2021 survey uncovered that 45% of respondents own a wearable and over half of users continued using the wearable throughout the year (Rock Health 2022). The normalization of wearables and the FDA approval of medical devices embedded in these products, such as Apple’s atrial fibrillation feature (Apple Insider 2022), is creating more opportunities for providers to monitor and treat patients remotely in real-time. |

Headwinds of RPM

| Fix the Digital Divide | A lack of access to the internet, digital technologies, and skills has a negative impact on people’s lives and contributes to poorer health outcomes. In the US, the digital divide impacts lower-income households (household income < USD$30K), people over the age of 65, and rural households (Deloitte 2021). Widespread uptake of RPM devices and DTx will continue to be hindered while inequities in access and use of technology continue. |

| Winter is Coming | While COVID-19 stimulated investment into digital health technologies, a recent webinar between Decimal.health and Seae Ventures highlighted that there has been a drop in venture funding during 2022. Unfortunately, today’s market conditions make it challenging for digital health companies to maintain previously high valuations and also to attract further cash investment. Watch our webinar, Is Winter Coming (Again)?, to learn more about 2022’s digital health funding climate. |

| Equipping Providers to Adopt RPM | As we mentioned in our previous blog, “Can RPM/RTM Codes Solve the Provider Adoption Problem for Digital Therapeutics?” providers are hesitant to adopt DTx solutions for various reasons. The existence of RPM/ RTM codes alone is not enough to drive provider adoption, as healthcare organizations are not experts in adopting or setting up DTx and RPM programs. We recommend companies working in this space should look to support the adoption and implementation of their RPM products into the healthcare organization; this often goes beyond technical support to education on how to use the technology effectively and how to insert it into established clinical pathways and practices. |

Conclusion

RPM helped the healthcare market bridge care delivery gaps during the pandemic. The dramatic uptick in RPM use during COVID-19 pushed the diagnosis, treatment, and management of patients away from traditional health settings to more comfortable home and community spaces. Combined with the market movement toward digital therapeutics (DTx) and growth in telemedicine, RPM further empowers patients to be active participants in their health.

Work with Decimal.health

Want to enter the RPM space? Reach out to a Decimal.health representative to learn more about Decimal.health’s expertise and how we can help you develop a go-to-market strategy and grow your business.

About Decimal.health

Decimal.health provides end-to-end solutions that help companies navigate the complicated healthcare ecosystem and become a market leader rather than a market follower. The team brings several decades of deep experience in digital health, provider, and payer systems to help digital health businesses develop strategies that accelerate the launch and growth of their business and maximize their impact. Decimal.health combines relevant clinical and care delivery experience with the technology needs of our care providers and patients to create useful, usable, and enjoyable product experiences.

Related Articles

Innovation Estonia : DTX Estonia 2023

Dr.Kamal Jethwani, Managing Partner and CEO, Decimal.health shares some powerful insights from his week-long experiences at DTx Estonia 2023 where he delved into the dynamic world of digital health and entrepreneurship!

GenerativeAI: Using and managing this new technology responsibly

Can GenerativeAI really revolutionize the healthcare industry and improve patient outcomes? In our latest webinar, Decimal.health brought together healthcare and industry leaders to discuss real-world use cases of where GenAI can improve patient access and beyond, and talk candidly about what.

Digital therapeutics should work ‘like magic’ to succeed in clinical care

Decimal.health was featured in an article by the Mobihealth news about the panel presentation at HIMSS23 that Kamal Jethwani participated in.