Globally, the Remote Patient Monitoring (RPM) market is valued at USD $4.4B (2022) and is expected to register a compound annual growth rate (CAGR) of 18.5% by 2030 (GrandViewResearch). As one of the largest healthcare markets, the US holds over 40% of the revenue share for the RPM market (GrandViewResearch). The US’s growth is also propelled by the rising number of chronic diseases amongst American adults, with nearly 200M adults having at least one or more chronic conditions (i.e., diabetes, hypertension). Aligned with this trend has been the adoption of RPM billing codes that were more clearly aligned with the trend of physiologic data collected via remote devices in 2018-19.

So, How Much are RPM codes Really Being Used?

As we see this growth in RPM and, potentially, its younger sibling Remote Therapeutic Monitoring (RTM), it is important to understand the context, adoption rates and potential revenue implications of these technologies. So, at Decimal.health, we took a beat to ask ourselves, How much are RPM and RTM billing codes really being used in the US?

From 2018-2022, 50,000 unique Qualified Health Professionals (QHPs) across 19,000 healthcare organizations billed an RPM code. Sixty-four percent (64%) of these QHPs billed for the very first time during the pandemic (DTx Alliance). Primary care clinicians like family practitioners, internal medicine and nurse practitioners are the most frequent billers (DTx Alliance). Cardiologists, nephrologists, gastroenterologists and psychiatrists made up the majority of new adopters during the pandemic (DTx Alliance). While seeing positive trends in adoption, however, there are over 1M eligible QHPs in the US who could bill for RPM and the majority of those have not yet started using RPM codes in their practice (AAMC, AANP, US Bureau of Labor Statistics).

Now, let’s take a look at how the usage figures contextualize. In 2021, on average 8,000 unique QHPs billed for RPM monthly. Since there are potentially over 1M eligible QHPs who could bill for RPM, this represents only 0.8% of eligible QHPs billing against RPM codes (DTx Alliance).

Looking at the figures from the patient side, in 2021, 619K US patients had an RPM-related procedure claim (billing claims made by the aforementioned QHPs) (Definitive Healthcare). However, the number of patients with RPM-related procedure claims made is only 19K more than those made in 2020 (Definitive Healthcare). This equates to a mere 3.2% increase.

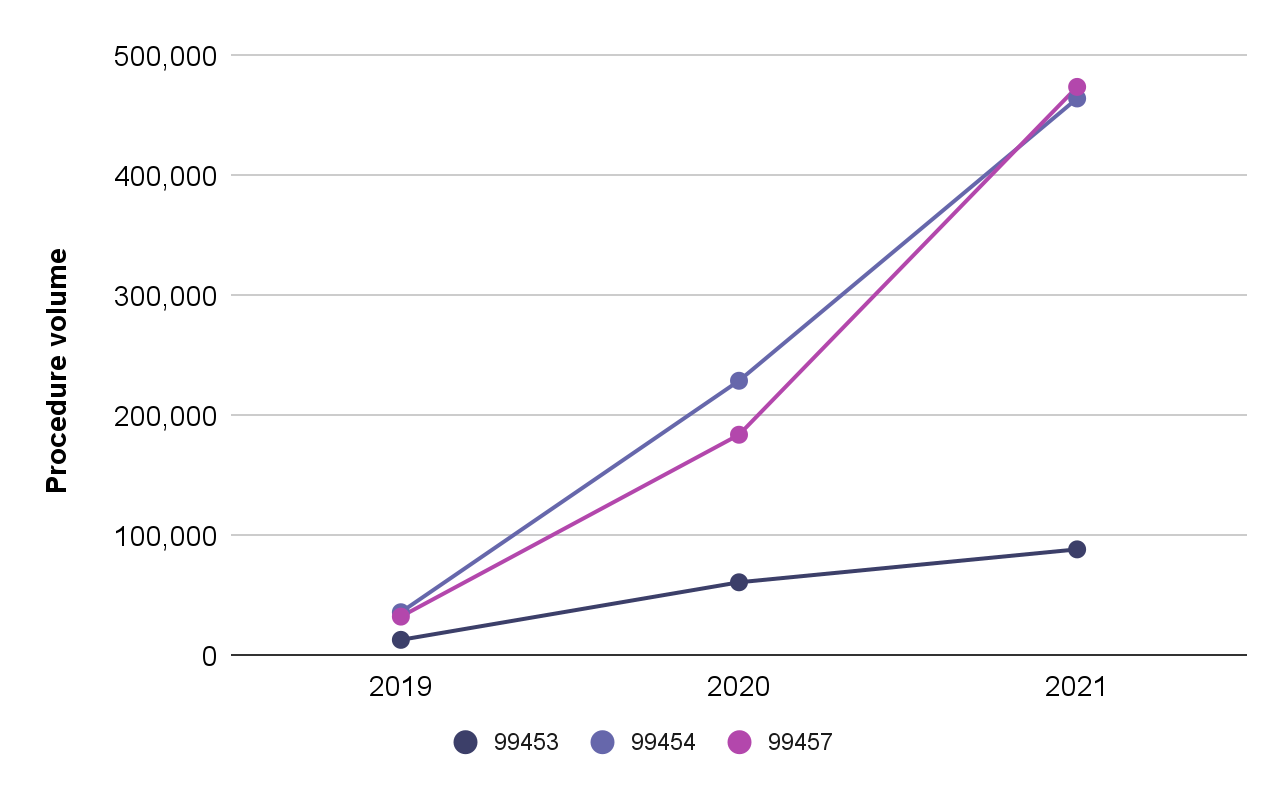

On the other hand, while RPM-related procedure claims had a small increase, the number of claims against RPM codes did increase substantially between 2020 and 2021. The billing for RPM services by clinical staff, first 20 minutes of RPM services over a 30-day period (CPT 99457) increased from under 200,000 (2020) to just under 500,000 (2021).

Volume of RPM Procedures From 2019-2021

Figure: Volume of RPM procedures from 2019-2021, showing increases in usage for: (i) initial set-up and patient education on equipment (CPT 99453), (ii) supply of devices, collection, transmission and report/summary services to the clinician (CPT 99454), and (iii) RPM services by clinical staff – first 20 cumulative minutes of RPM services over a 30-day period (CPT 99457) (Definitive Healthcare 2019, 2022)

Additionally, looking at code CPT 99454 (supply of devices, collection, transmission and report/summary services to the clinician) we saw yet another drastic increase in the number of RPM claims made. Claims against this code rose from 36,200 (2019) to 464,400 (2021) (Definitive Healthcare 2019, 2022) indicating that providers who started using RPM increasingly used the codes at scale. The data suggests that QHPs who adopt RPM codes are likely to keep billing against those codes.

So, while we’re seeing a steady increase in RPM code billing and reimbursement, these codes will not be cracking the Top 25 Most Billed Physician Procedures anytime soon (Definitive Healthcare). But that is to be expected, it can take several years and effort to overcome hurdles to mainstreaming digital technologies, like RPM products, into healthcare organizations, clinical practice and reimbursement mechanisms. In our next blog we’ll look at the Changing RPM Landscape to learn more about the headwinds and tailwinds of RPM adoption.

What About the RTM Codes?

RTM has a different focus than RPM, referring to the management of patients utilizing medical devices that collect non-physiological data. RTM codes capture and analyze outcomes such as therapy response and patient adherence related to treatment associated with musculoskeletal (MSK), cognitive behavior and respiratory conditions.

Launched in 2022, digital health companies are retrofitting and upgrading their current products to leverage the new RTM codes. Limber Health’s digital MSK platform, for example, allows physical therapy clinics to assign home-exercise programs, monitor and track patient progress, and offer treatment management services – tapping into the new RTM codes at each interaction.

In the first five months following the launch, we saw the use of RTM codes trending upwards with approximately 500 unique QHPs submitting for billing across just over 2,000 unique patients (DTx Alliance). The low utilization of RTM codes is due to the code’s newness. When new reimbursement codes are introduced by CMS, raising awareness and facilitating adoption at the provider level takes time. It is expected to take several years before we see measurable reimbursement activity for RTM codes (Nature).

However, the trajectory of RPM code adoption could provide a relevant growth parallel for RTM. If RTM shows a similar uptake trajectory as RPM, then we predict around 900 to 1,000 unique QHPs to adopt and start using RTM by mid-2024. Companies looking to enter the nascent RTM market should consider the value of the longer-term, multi-year play and, modeling off RPM growth trajectory, the potential value of the RTM market in five years.

Can RPM and RTM drive Digital Therapeutic Adoption?

In short, yes. Let’s unpack this.

Digital therapeutics (DTx) products are increasingly being evaluated and approved for use as evidence-based interventions to help prevent, manage or treat health conditions. DTx products are part of the broader shift in healthcare towards decentralizing care, taking advantage of the growing capabilities of digital technologies to enable care delivery where the patient is at the right time (Mann & Lawrence 2022).

At the base of decentralized care is the concept of a continuous connected care system where providers can both monitor and intervene with patients as needed (Mann & Lawrence 2022). But that data needs to come from somewhere. This is how DTx products and RPM/RTM products complement each other.

A lot of DTx’s can use RPM products and through those products, or their own functions, collect RPM and RTM data as part of their service offering. RPM and RTM products, in combination with DTx or otherwise, enable providers to continuously monitor and interact with patients. Used as a component in a digital strategy and service offering, these tools can help drive digital health adoption and also enable the model of decentralized, continuous connected care.

It is wonderful to have a mechanism to value my team’s time spent on reviewing data coming from these devices. For complex patients with high ongoing needs, it helps my team collect relevant objective data and monitor it over time, as opposed to addressing issues over the phone with patients without any real data to back it up. For the longest time, it has been hard for us to get reimbursed for phone calls – so RPM codes are a huge improvement.

Pulmonologist, Large AMC on the East Coast

However, as we’ve explored above, the existence of RPM/ RTM codes alone is not enough to drive provider adoption. Health care organizations are not experts in adopting or setting up DTx and RPM programs so companies working in this space should look to support that adoption and implementation piece:

These types of RPM programs, such as hospital at home and chronic care management, are new and there’re not a lot of experts in them yet. So hospitals value partnership with — for example, the client success managers that know how to set up this program, and they like to have a client support specialist that’s on call 24/7. That connection is valuable when you’re starting up a new program, especially when they’re investing so many dollars towards it, they want to see that ROI.

Former Chief of Staff, RPM company

At Decimal.health we guide our companies to understand that providing support to health care organizations when they’re starting a new program or trying a novel DTx technology can be invaluable. Including reimbursement support as a component within that is a nice add on for demonstrating return on investment for using new technologies and models working. Additionally, in a recent Decimal.health provider survey on driving DTx adoption, physicians emphasized that clinical evidence continues to be the most important factor for driving awareness and adoption.

Conclusion

RPM/RTM products represent an important tool for incorporating digital solutions into existing clinical workflows. However, with RPM and RTM codes being relatively new to healthcare, companies creating DTx should recognize the codes alone will not drive adoption. Companies pursuing DTx should position their use cases to address critical market needs, strive to gather robust clinical and economic evidence, ensure health care organizations feel supported to implement the technologies, and create business models that are not solely based on RPM/RTM codes.

About Decimal.health

Decimal.health provides end-to-end solutions that help companies navigate the complicated healthcare ecosystem and become a market leader rather than a market follower. The team brings several decades of deep experience in digital health, provider and payer systems to help digital health businesses develop strategies that accelerate the launch and growth of their business and maximize their impact. Decimal.health combines relevant clinical and care delivery experience with the technology needs of our care providers and patients to create useful, usable, and enjoyable product experiences.

Related Articles

Innovation Estonia : DTX Estonia 2023

Dr.Kamal Jethwani, Managing Partner and CEO, Decimal.health shares some powerful insights from his week-long experiences at DTx Estonia 2023 where he delved into the dynamic world of digital health and entrepreneurship!

GenerativeAI: Using and managing this new technology responsibly

Can GenerativeAI really revolutionize the healthcare industry and improve patient outcomes? In our latest webinar, Decimal.health brought together healthcare and industry leaders to discuss real-world use cases of where GenAI can improve patient access and beyond, and talk candidly about what.

Digital therapeutics should work ‘like magic’ to succeed in clinical care

Decimal.health was featured in an article by the Mobihealth news about the panel presentation at HIMSS23 that Kamal Jethwani participated in.